Sales return isn’t exactly an expense or a loss to the company, however, it reduces current assets (in the case of credit sales), and therefore, it indirectly acts as a loss. Accounting for a sales allowance is fundamentally similar to accounting for a sales return. That’s why it’s vital to understand get your second stimulus check 2020 the items that come up on one, what they mean, and how to find and record them. For locations with sales taxes, you also need to record the sales tax that your customer paid so you know how much to pay the government later. You also have to make a record of your inventory moving and the sales tax.

Create a Free Account and Ask Any Financial Question

- The sales allowance is granted to buyers for the above-mentioned reasons, whereas the sales discount is granted for quick and timely payments.

- In this case, the “sales returns and allowances” account is required for recording such transactions.

- A company, ABC Co., sold goods worth $100,000 to another company, XYZ Co.

- In a company’s general ledger, both sales returns and sales allowances are recorded in a single account known as the sales returns and allowances account.

Like sales returns, companies have to record sales allowances separately. Sales returns and allowances are not expenses, but they are recorded as deductions from a company’s gross sales. This account has a negative or debit balance, so it is also called a contra-revenue account. In this case, the company provides an allowance to customers as compensation and the customers do not need to return goods. Hence, there is no impact on inventory and cost of goods sold transaction. So, only sales return account and its related credit size are recorded in the journal entry.

What is a sales revenue journal entry in accounting?

Sales returns and allowance are the contra account to the sales revenues where the previously recognized sales need to be derecognized by recording into this account. If it were the credit sales, then we should credit to the account receivable account. If the sales were cash sales, we should credit them to the cash or bank account since the company will need to pay back to the customer. Either cash sale or credit, we need to reduce cash or account receivable accounts and reduce the revenues.

How to Record a Sales Revenue Journal Entry

It is deducted from “Sales” (or “Gross Sales”) in the income statement. Sales returns refer to actual returns of goods from customers because defective or wrong products were delivered. Sales allowance arises when the customer agrees to keep the products at a price lower than the original price. Therefore, sales returns are goods that customers return to a company. In other words, it is the goods received from a customer due to various reasons. Usually, companies have a policy that states whether they accept goods returned by customers.

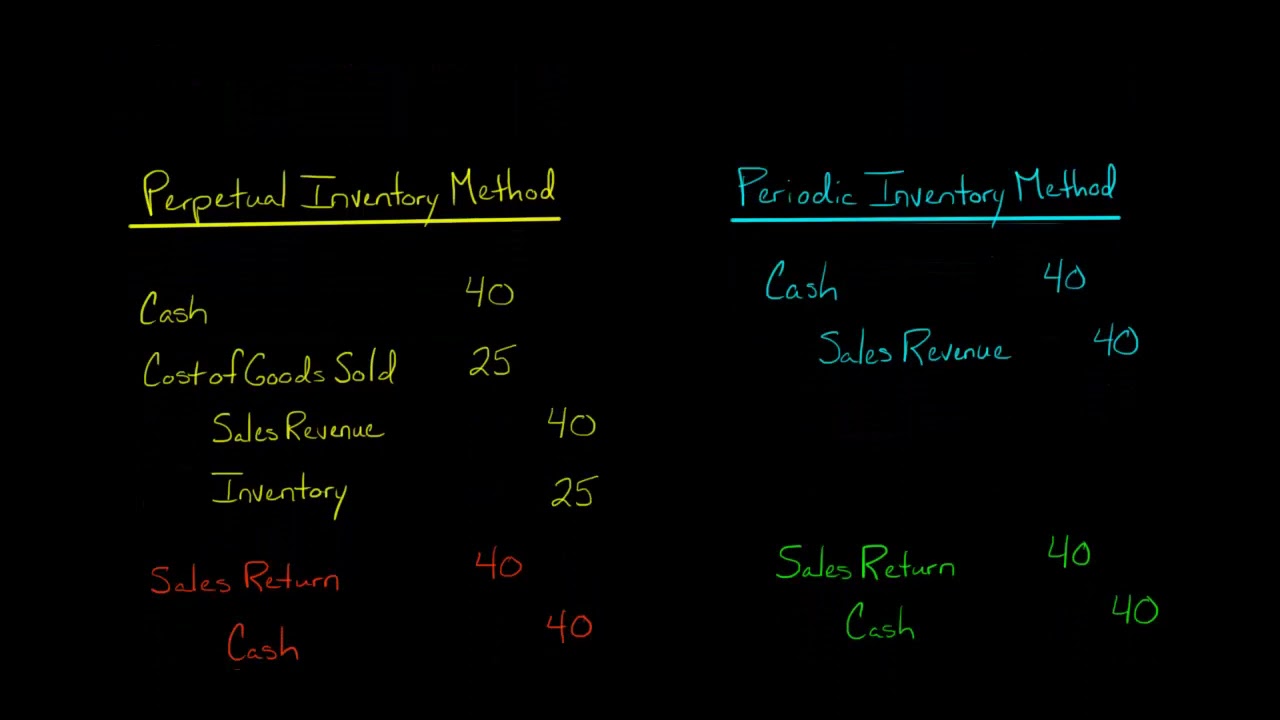

When you credit the revenue account, it means that your total revenue has increased. Sales are credit journal entries, but they have to be balanced by debit entries to other accounts. So, instead of adding it to your revenue, you add it to a sales tax payable account until you remit it to the government. If a customer originally made their purchase on credit, the sale was part of your accounts receivable, which is money owed to you by customers. Sales returns are an important part of the sales process because it allows a company to continuously provide high-quality goods and services to their customers. As mentioned above, under the perpetual inventory system, there is an additional entry to record the reduction of cost of goods sold and the increase in merchandise inventory.

But knowing how entries for sales transactions work helps you make sense of your general journal and understand how cash flows in and out of your business. To update your inventory, debit your Inventory account to reflect the increase in assets. And, credit your Cost of Goods Sold account to reflect the decrease in your cost of goods sold. The Sales Returns and Allowances account is a contra revenue account, meaning it opposes the revenue account from the initial purchase. You must debit the Sales Returns and Allowances account to show a decrease in revenue.

However, at the time of delivery, ABC Corporation found goods worth 2,000 as unfit because they were damaged in transit. For instance, if a buyer were to purchase the aforementioned hard-boiled egg machine and notice only five out of its six egg-cooking modules are operational, they might ask for an allowance. Because you are not immediately paying the customer, you must increase the amount you owe through an Accounts Payable entry.

Sales returns and allowances are contra revenue accounts in the financial statements. Usually, companies provide a breakup of the contra revenue account to calculate the net sales figure in the income statement. Sales return and allowances is an item revenue presented as a reduction of sales revenue in the income statement. As mentioned above, it is a contra account of sales revenue account; therefore, sales return and allowances are recorded on the debit side.

If a customer does not agree to exchange goods, the company will repay them or reduce their receivable balance. Sales returns are considered an expense in accounting and are not included in the cost of goods sold. On the credit side, an Accounts Payable account should be recorded along with other applicable accounts, such as Cash or Inventory (for physical goods). Suppose a customer bought a leather jacket from Jill, a shop owner, for $300. However, a week later, they returned the jacket, citing problems with its fitting and quality.

The company that receives the goods back must return them as sales returns. Companies that sell physical goods may also offer sales returns policies. Usually, these companies produce the goods or acquire them from an external source.