Through a perpetual system, businesses are also able to access inventory reports at all times, and reduce human error through automation. Thus, the above are some characteristics of periodic inventory system which some companies follow to make their system efficient and transparent. After subtracting the ending inventory from this total, the remaining balance represents 110 tax humor ideas the cost of the items sold. However, the sheer volume of transactions in some merchandising businesses makes it impossible to use anything but the periodic system. Learn more about how you can manage inventory automatically, reduce handling costs and increase cash flow. They report the ending inventory for each purchase date first, then add them up.

The Financial Modeling Certification

Let’s say you are running a retail business, in which your firm must purchase inventory almost every day to run your day-to-day business. Of course, some of that inventory can become” Finished Goods” and be sold during the period, but your accountant doesn’t need to worry about that. Instead, a “purchase account” will be created in a periodic system for each bought inventory, which is an ‘asset.’ All the inventory purchases are stored in this account. When the company purchases the inventory, they have to record it into the purchase account which is the inventory sub-account.The journal entry is debiting the purchase account and credit accounts payable/cash.

- The net sale will be recorded only $ 9,500 due to the discount while the accounts receivable increase only $ 9,500 too.

- It doesn’t, however, account for broken, damaged, or lost goods and also doesn’t typically reflect returned items.

- Now, keep in mind that the previously mentioned advantages only benefit small businesses that deal with a couple of hundred sales a year.

- It is among the most valuable assets that a company has because it is one of the primary sources of revenue.

Perpetual LIFO

Thus, many companies only conduct physical inventory counts periodically. A periodic inventory system is a commonly used alternative to a perpetual inventory system. That system of updating merchandise inventory for every transaction, in and out, is called the perpetual system.

Perpetual vs Periodic Inventory System

The inventory increase will not update, we only use the temporary account (purchase). The cost of goods sold will not be recorded as well, we only calculate it at the month-end. In a perpetual LIFO system, the company also uses the running ledger tally for purchases and sales, but they sell the inventory that they last purchased before moving to older inventory. In other words, the cost of what they sell is the same as what they most recently paid for that inventory.

Periodic Inventory Accounting

In the meantime, the inventory account in the accounting system continues to show the cost of the inventory that was recorded as of the last physical inventory count. This means that the inventory valuation in the accounting records will be inaccurate, except when a physical count is performed. This can be acceptable in cases where management is not overly concerned about the inventory valuation on a day-to-day basis. The transaction will increase the inventory balance as the purchase account is under the inventory account.

Different between Periodic and Perpetual

What we started with (beginning inventory) plus purchases gives us what we would have on hand if we didn’t use any. So there’s no longer a need for businesses to manually count their merchandise, or write down journal entries by hand. Want to learn more about journal entries and how to record them for your small business? Head over to our guide on debit and credit entries, with practical examples.

First, you add the inventory amount at the beginning of the year to the amount reflected on the Purchases account, to figure out the total cost of goods available for sale. If your business doesn’t have a clearly defined beginning inventory amount, you can use the remaining stock number from the end of the previous period. That’s why a periodic inventory system is only mainly used by small businesses with limited inventory and few financial transactions. Small merchandising businesses can track their inventory with an inventory management approach known as the periodic inventory system. But task can become tedious ad complicated if the quantity of inventory is very high and it also involves may types of the same. There is also the possibility of error while counting, misplacement or theft leading to inaccuracy.

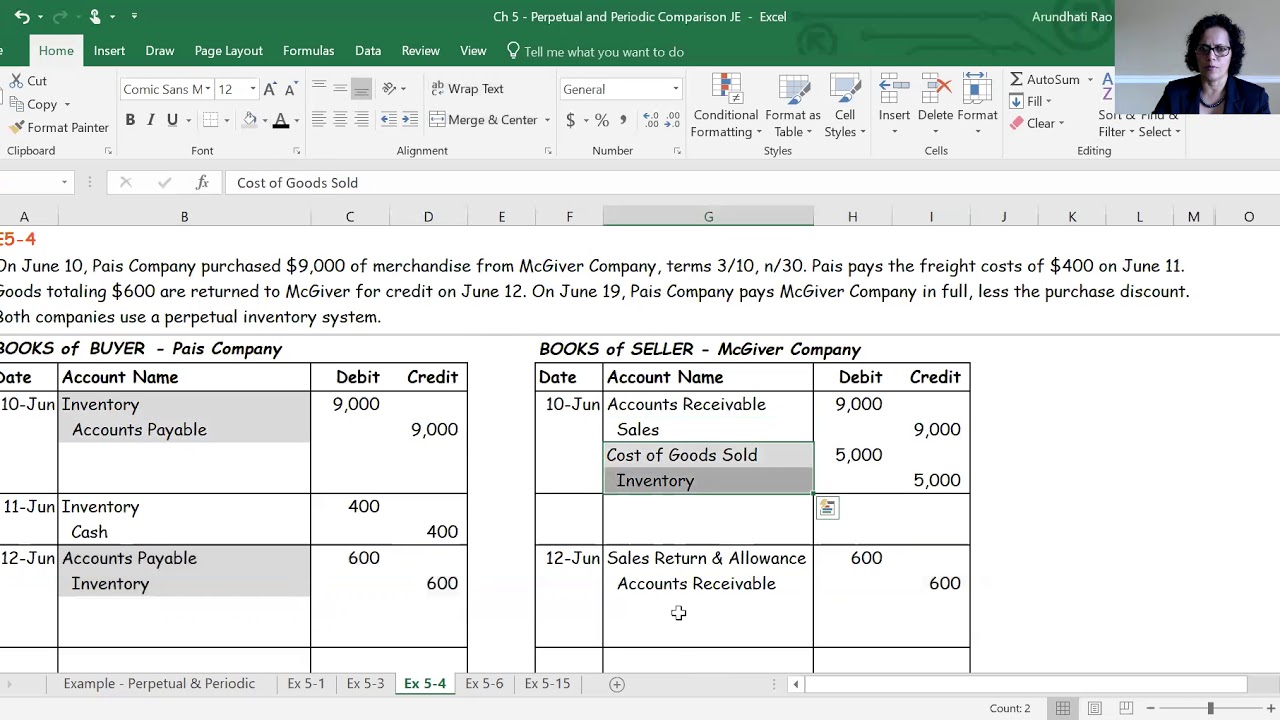

Restaurants, sandwich shops, ice cream stores, and the like might well choose to use a periodic system because purchasing usually takes place at the establishment where quantities are easy to observe and manage. The information provided by a perpetual system does not necessarily provide additional benefit. A company’s COGS vary dramatically with inventory levels, as it is often cheaper to buy in bulk, especially if it has the storage space to accommodate the stock. Buyers must record shipping charges as transportation in (or Freight In) when the goods were shipped FOB shipping point and they have received title to the merchandise. We learned shipping terms tells you who is responsible for paying for shipping.

A simplified form of the above journal entry uses a single debit or credit to inventory account by calculating the difference of ending inventory and beginning inventory. If the difference is positive, the inventory account will be debited for the difference and if it the difference is negative, the journal entry will credit the inventory account by the difference. It also increases the accounts receivable and cash based on the nature of the sale. When using the perpetual inventory system, the Inventory account is constantly (or perpetually) changing.

Weighted average cost (WAC) in a periodic system is another cost flow assumption and uses an average to assign the ending inventory value. Using WAC assumes you value the inventory in stock somewhere between the oldest and newest products purchased or manufactured. Record inventory sales by crediting the accounts receivable account and crediting the sales account. In a periodic system, you enter transactions into the accounting journal. This journal shows your company’s debits and credits in a simple column form, organised by date. The main benefits of employing a periodic inventory system are the ease of implementation, its lower cost and the decrease in staffing needed to run it.

Periodic system examples include accounting for beginning inventory and all purchases made during the period as credits. Companies do not record their unique sales during the period to debit but rather perform a physical count at the end and from this reconcile their accounts. The periodic inventory system is commonly used by businesses that sell a small quantity of goods during an accounting period.