However, it may also increase by controlling non-operating expenses and improving pricing. Generally, the higher the operating margin ratio the better it is for the business. Then, it helps a company understand the gross profitability of a product line. This is because fee-for-service hospitals have a positive contribution margin for almost all elective cases mostly due to a large percentage of OR costs being fixed. For USA hospitals not on a fixed annual budget, contribution margin per OR hour averages one to two thousand USD per OR hour.

Variable Costs

As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services. This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. Contribution margin is a business’s sales revenue less its variable costs. The resulting contribution dollars can be used to cover fixed costs (such as rent), and once those are covered, any excess is considered earnings.

Step 3 of 3

The resulting value is sometimes referred to as operating income or net income. Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered.

Calculating the Contribution Margin and Ratio

Accordingly, in the Dobson Books Company example, the contribution margin ratio was as follows. Now, this situation can change when your level of production increases. As mentioned above, the per unit variable cost decreases with the increase in the level of production. Direct Costs are the costs that can be directly identified or allocated to your products. For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods.

When a company’s operating margin exceeds the average for its industry, it is said to have a competitive advantage, meaning it is more successful than other companies that have similar operations. While the average margin for different industries varies widely, businesses can gain a competitive advantage in general by increasing sales or reducing expenses—or both. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

The Indirect Costs are the costs that cannot be directly linked to the production. Indirect materials and indirect labor costs that cannot be directly allocated to your products are examples of indirect costs. Furthermore, per unit variable costs remain constant for a given level of production. The contribution margin is a financial metric that represents the amount of revenue available to cover fixed costs and contribute to profit after deducting variable costs.

As of Year 0, the first year of our projections, our hypothetical company has the following financials. Accordingly, the net sales of Dobson Books Company during the previous year was $200,000. Take your learning and productivity to the next level with our Premium Templates. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.

- Below is a break down of subject weightings in the FMVA® financial analyst program.

- This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period.

- Now, let’s try to understand the contribution margin per unit with the help of an example.

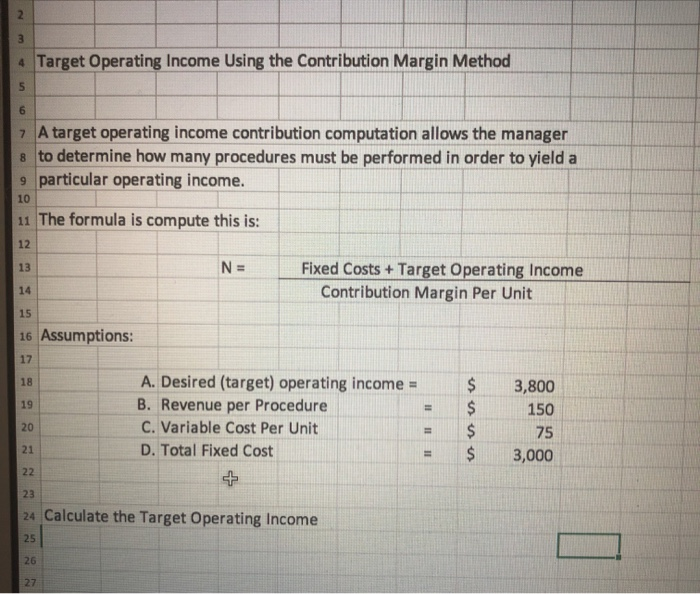

- It is important to assess the contribution margin for break-even or target income analysis.

To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit. The formula to calculate the contribution margin is equal to revenue minus variable costs. The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage. That is, this ratio how to get started with invoicing for your photography business calculates the percentage of the contribution margin compared to your company’s net sales. A higher contribution margin indicates a higher proportion of revenue available to cover fixed costs and contribute to profit. The concept says fixed costs are often one-time expenses that do not contribute directly to the costs of production.

Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\).