Default on the due date can also lead to penalties or legal proceedings against the defaulter. The Accounts Receivable account is debited, as the business expects to receive payment from the buyer at a later date. If they do not pay off the balance within the given timeframe, the customer’s credit score may be negatively affected. As a result, customers are more likely to pay off their balance in a timely manner, reducing the risk of credit default.

Types of Sales Transactions

Creating a credit sales journal entry usually involves a debit to the account receivable and a debit to the sales account. For businesses that offer their products on credit, sales credit journal entry is essential. When a sale is made with a credit card, the accounts receivable account will be debited and, unless the money is received to cover the sale, will be shown as an asset on the company’s balance sheet.

Company

Accounts receivable account is credited when money is received on a later date. The person who owes the money is called a “debtor” and the amount owed is a current asset for the company. Companies are careful while extending credit as it may lead to bad debts for the business. When a business sells goods or services on credit, the buyer receives the goods or services immediately, with the promise to pay at a later date. As an example, suppose a business has credit card sales of 1,000, and the processing fee payable to the credit card company is 2% (20).

Example – Journal Entry for Cash Sales

The debit to the accounts receivable account will indicate that the customer has purchased goods or services on credit. The credit to the sales account will indicate that the company has earned revenue on the sale. A sales credit journal entry is made when goods are sold on credit rather than for cash. In order to record a sales credit journal entry, businesses need to have an understanding of accrual accounting. This accounting method records revenue when it is earned, regardless of when the cash is received.

As the business is using an accounts receivable control account in the general ledger, the postings are part of the double entry bookkeeping system. A sales credit journal entry is typically used when a business ships merchandise to a customer who hasn’t yet paid for it. For example, let’s say you run a furniture store and sell a couch to a customer on credit. A sales credit journal entry record enables businesses to credit the relevant account with the amount due and the specifics of the transaction.

Net Accounts Receivable

- The multi-column journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories.

- When companies offer credit to customers, the customers receive goods or services from the company without paying for them immediately.

- Assumed to be $1,000 in the example above is the basic value of the products.

- The data in your sales journal can give you valuable insights into your business’s performance.

It allows them to increase their sales and cash flow, while also managing their credit risk. The customer is required to make payment to the seller based on the credit term. When cash is collected, the company debits cash account and credit accounts receivable. The cash less the fee is received from the credit card company, the accounts receivable balance is cleared, and the credit card fee for processing is charged to the credit card expense account. The sales journal, sometimes referred to as the sales day-book, is a special journal used to record credit sales.

While revenue is easy to think about as “automatic” when the sale of a good or exchange of service happens, in reality, revenue is not always as liquid as it seems. Only when revenue is received in the form of an immediate cash payment does it truly qualify as revenue. Instead, accrued revenues are more likely for a business, especially when it comes to accounting best practices.

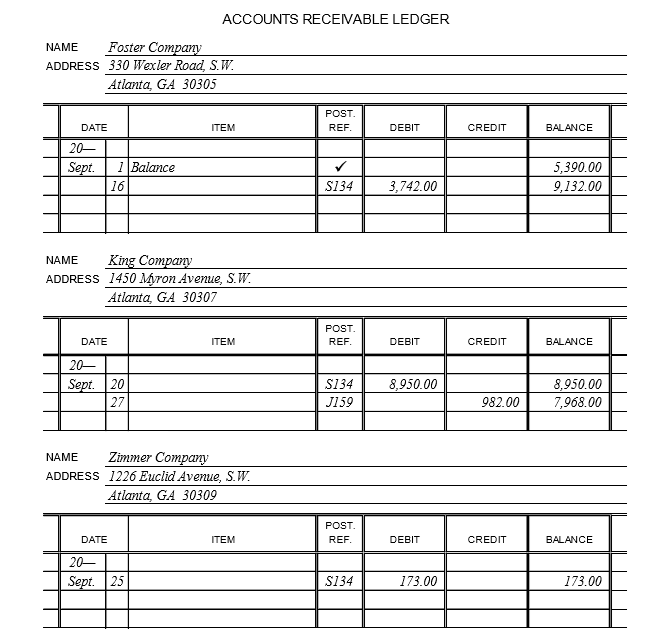

As previously mentioned, credit sales are sales where the customer is given an extended period to pay. There are several advantages and disadvantages for a company offering credit sales to customers. In this case the asset of cash has increased by 980 and the income statement has been credited with sales of 1,000 and credit card fees of 20. The 980 credit to the income statement increases the net income which increases the retained earnings and therefore the owners equity in the business. On a regular (usually daily) basis, the line items in the sales journal are used to update each customer account in the accounts receivable ledger.

Sales credit journal entries are an essential part of accrual accounting and help businesses correctly track and record revenue. The return of products or services by customers results in a fall in revenue, an increase in accounts receivable, or a decrease in accounts payable, depending on whether a refund is given. A sales credit journal entry is a crucial accounting record used to track this. For correct financial reporting and to keep the books of the firm open, these transactions must be properly recorded.

As with all other transactions, when companies sell goods or provide services on credit, they make a journal entry for the sale. When businesses understand how to make the credit sales journal entry, it aids them in making informed decisions about offering or withdrawing the option of purchasing goods and services on credit. It also aids in making better operational decisions and improves the management of finances. Here, our discussion shall focus on how to make the credit sale journal entry, examples, and the advantages and disadvantages of credit sales. In conclusion, the credit sales journal entry is a critical method for managing customer accounts and keeping track of sales. By clearly documenting all sales credits, businesses can avoid errors and ensure that customers are properly credited for their purchases.

For instance, if a company sells consumables to retailers and gets paid say in a month from the time of goods delivery, they will have to record the sale as a credit sale pending when they receive the payment. The account receivable records all monies owed to the company by customers who received either goods or services on credit. There are basically two journal entries made to record credit sales; first when the good or service is purchased and then later on when the good or service is paid for. Both of these journal entries are useful when preparing financial statements, forecasting the business’s revenue as well as budgeting for the future.